What’s the Difference Between Medicaid and Medicare for Seniors?

As seniors age, access to reliable healthcare becomes more critical than ever. Many rely on government-sponsored programs to cover medical expenses, but understanding the options available can be overwhelming. Two of the most well-known programs—Medicare and Medicaid—provide essential healthcare coverage, yet they serve different purposes and have distinct eligibility requirements.

This article will break down the key differences between Medicare and Medicaid, covering eligibility, benefits, costs, and how these programs work together for seniors who qualify for both. By the end, you’ll have a clearer understanding of which program best suits your needs or the needs of a loved one.

Eligibility: Who Qualifies for What?

Understanding eligibility is the first step in determining whether Medicare or Medicaid is the right fit—or if you qualify for both. While both programs serve seniors, they do so in very different ways.

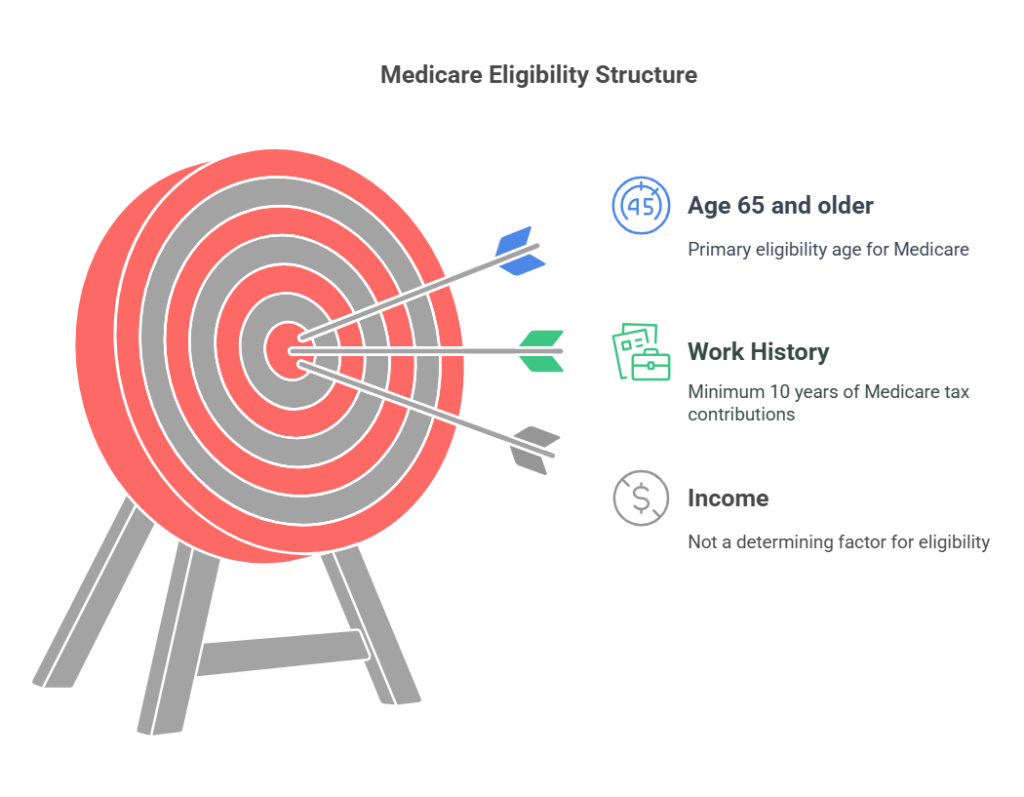

Medicare: Age and Medical Qualifications

Medicare is primarily designed for seniors aged 65 and older, regardless of income. Once you reach this age, you’re typically eligible if you or your spouse have worked and paid Medicare taxes for at least 10 years.

However, younger individuals can also qualify under special circumstances, including:

Certain disabilities: If you’ve received Social Security Disability Insurance (SSDI) for at least 24 months, you may be eligible for Medicare before turning 65.

End-Stage Renal Disease (ESRD): Permanent kidney failure requiring dialysis or a transplant.

Amyotrophic Lateral Sclerosis (ALS): Also known as Lou Gehrig’s disease.

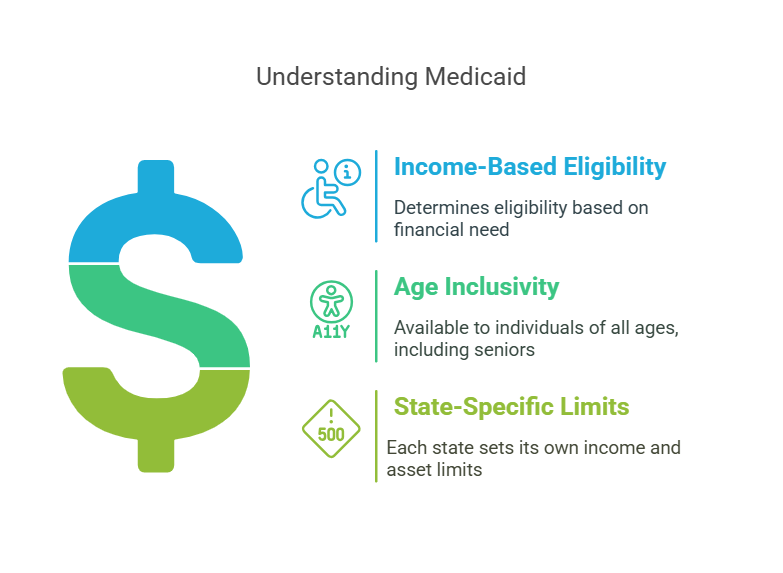

Medicaid: Financial Need Determines Eligibility

Unlike Medicare, Medicaid is income-based, meaning eligibility depends on financial need. The program is available to individuals of all ages, including seniors, but each state sets its income and asset limits.

Generally, Medicaid is designed for:

- Low-income seniors who need additional financial support for medical expenses.

- People with disabilities who meet state-specific income and asset thresholds.

- Individuals requiring long-term care (such as nursing home services) who meet financial eligibility.

Because Medicaid is a state-administered program, requirements vary, so checking with your state’s Medicaid office is essential to determine eligibility. Some seniors qualify for both Medicare and Medicaid, which can help reduce out-of-pocket costs significantly.

Long-Term Care: What Are the Options?

As seniors age, the need for long-term care becomes a reality for many. Whether it’s in-home assistance, nursing home care, or rehabilitation after a hospital stay, understanding how Medicare and Medicaid cover these services is crucial.

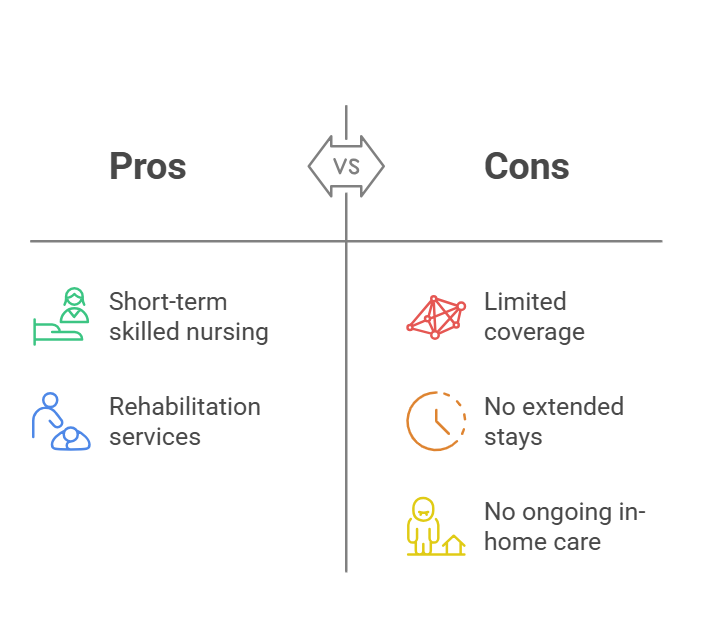

Medicare: Short-Term Help, Not a Long-Term Solution.

Medicare provides limited coverage for long-term care, focusing on short-term skilled nursing and rehabilitation rather than extended stays in a nursing home or ongoing in-home care.

Here’s what Medicare covers:

- Up to 100 days of skilled nursing facility (SNF) care after a qualifying hospital stay.

- Short-term rehabilitation services, such as physical or occupational therapy.

- Home health care for a limited time (if deemed medically necessary).

However, Medicare does not cover custodial care—assistance with daily activities like bathing, dressing, or eating—unless it is part of a short-term rehabilitation plan.

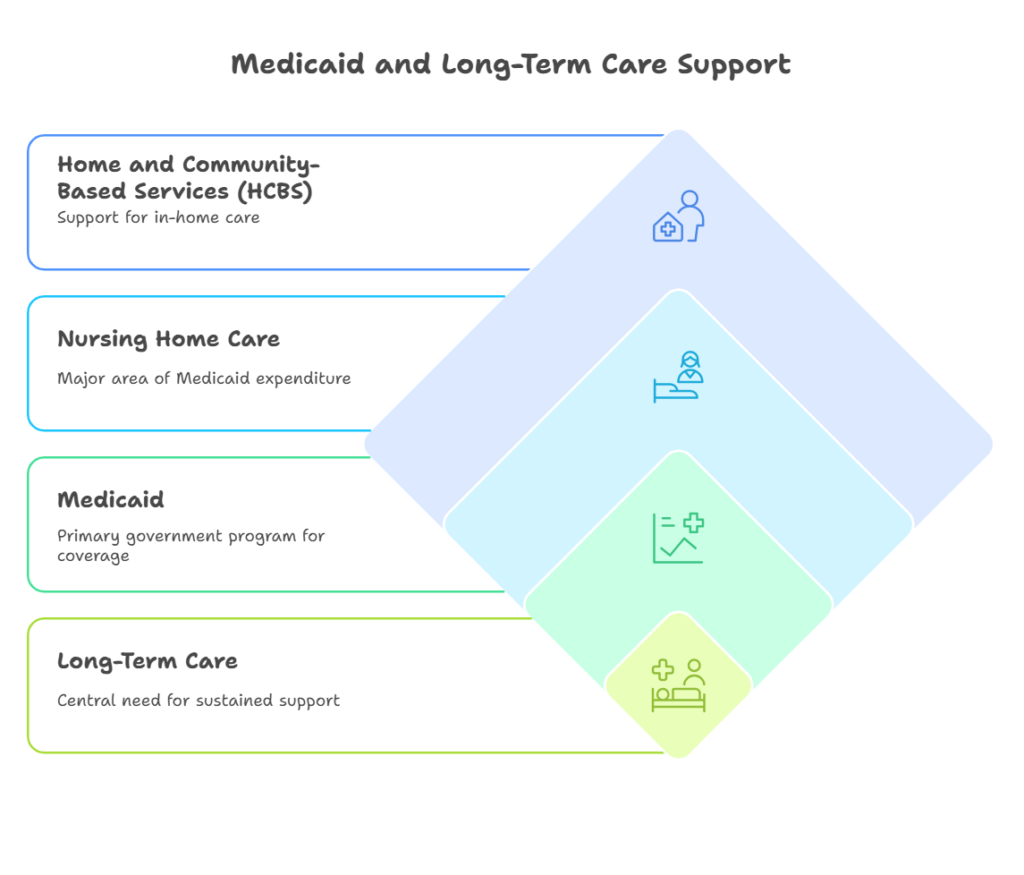

Medicaid: The Primary Payer for Long-Term Care

If you need long-term care, Medicaid is the main government program that provides coverage. It is the largest payer for nursing home care in the U.S. and also helps cover home- and community-based services (HCBS) for eligible seniors who wish to remain in their homes.

Medicaid covers:

- Nursing home stays for individuals who meet medical and financial eligibility.

- In-home care services, including personal care assistance and home health aides.

- Assisted living support in some states, depending on Medicaid waivers.

Since Medicaid eligibility is income- and asset-based, many seniors spend down their assets to qualify for coverage when long-term care is needed.

For seniors who anticipate needing extended care, understanding the difference between Medicare’s short-term coverage and Medicaid’s long-term benefits is essential in planning for future healthcare needs.

Dual Eligibility: Can You Have Both?

Some seniors qualify for both Medicare and Medicaid, a status known as dual eligibility. This can provide significant financial relief by combining the benefits of both programs.

How Dual Eligibility Works

- Medicare serves as the primary insurance, covering hospital stays, doctor visits, and outpatient care.

- Medicaid acts as a secondary payer, covering additional costs that Medicare doesn’t, such as long-term care, prescription drugs, and certain out-of-pocket expenses.

Financial Benefits of Dual Eligibility

For qualifying individuals, Medicaid can help cover:

- Medicare premiums, including Part B (medical insurance) and sometimes Part D (prescription drug coverage).

- Deductibles and copayments, reducing out-of-pocket expenses.

- Long-term care costs, such as nursing home stays or in-home services, which Medicare doesn’t fully cover.

Seniors who qualify for both programs can receive comprehensive healthcare coverage with minimal personal expenses, ensuring access to essential medical services and long-term care.

Final Thoughts

Understanding the differences between Medicare and Medicaid is essential for seniors navigating their healthcare options.

Quick Recap:

- Eligibility: Medicare is primarily for those 65+ or with certain disabilities, while Medicaid is based on financial need and varies by state.

- Coverage: Medicare provides hospital and medical insurance, but limited long-term care, whereas Medicaid offers broader coverage, including nursing home care and additional services.

- Costs: Medicare involves premiums, deductibles, and copays, while Medicaid is low-cost or free for those who qualify.

What’s Next?

If you’re unsure which program suits your needs—or if you might qualify for both—it’s worth exploring your options:

- Visit Medicare.gov for official information.

- Check your state’s Medicaid program through Medicaid.gov.

- Speak with Isaiah Home Healthcare or senior assistance program to get personalized guidance.

By understanding these programs, seniors can make informed healthcare decisions that align with their medical and financial needs.